Going abroad for higher education can be a life-changing experience, but the cost of tuition and living expenses can be daunting. That’s where an education loan comes into play. Education loans are designed to help students finance their higher education abroad. However, the process of getting an education loan for studies abroad can be complex and time-consuming. In this ultimate guide, we will explain everything you need to know about how to get an education loan for abroad studies, including the eligibility criteria, documents required, repayment options, and more. By following these tips, you can easily secure the funding you need to achieve your educational goals. So, let’s dive in!

Why Is an Education Loan a Good Choice for Studying Abroad?

An education loan could be the answer to all your funding problems. Not only will it help you achieve your dream of studying abroad, but you will also get to keep your savings. Here are the top reasons why an education loan is a great option for studying abroad.

- Covering High Costs: Studying abroad can be expensive, but an education loan covers tuition fees, living expenses, and other costs.

- No Collateral: Most education loans don’t require any collateral, making it easier for students to secure funding.

- Flexible Repayment: Education loans offer flexible repayment options, allowing students to repay the loan after graduation.

- Easy Application: Banks and financial institutions make it simple to apply for an education loan. You can apply online or in person.

- Boosts Credit Score: Repaying an education loan on time can help improve your credit score.

- Tax Benefits: Interest paid on an education loan is tax-deductible, providing additional savings.

- Low-Interest Rates: Education loans generally have lower interest rates compared to other types of loans.

An education loan provides a solution to finance your education abroad, offering flexibility and affordability. So, it’s a good option for students who want to study abroad. Still confused about how to get an education loan for abroad studies? We can help!

At Transglobal, we have expert study abroad consultants who can guide you through the process and help you with financial aid to study abroad.

Types of Educational Loan

When it comes to education loans for abroad studies, there are two main types: secured and unsecured loans.

- Secured Loans: These loans are backed by collateral, such as property or other assets. They offer lower interest rates but require a co-signer or a guarantor. If you’re unable to repay the loan, the lender can seize your collateral.

- Unsecured Loans: These loans don’t require collateral but have higher interest rates. These loans are based on your credit score, income, and other factors. There’s no collateral involved, but your loan provider will assess your ability to repay the loan.

Consider both types of education loans carefully, weighing the pros and cons of each. A secured loan may be a better option if you have a co-signer or collateral to offer. An unsecured loan might be better if you have a good credit score or a stable income.

Regardless of which type of education loan you choose, make sure to compare your options and choose a loan that best fits your needs. Read the terms and conditions carefully, and be sure to budget for loan repayment as you plan for your studies abroad.

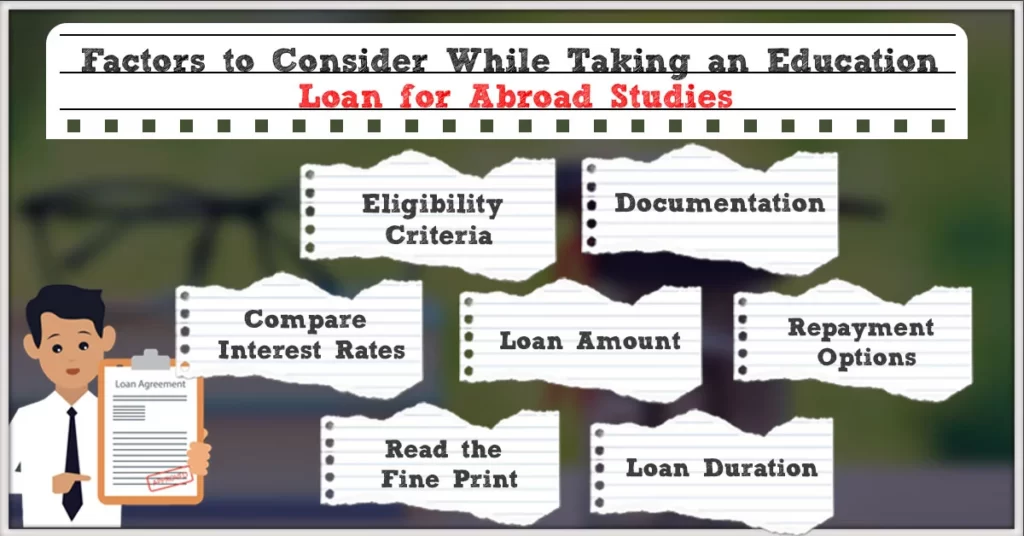

Factors to Consider While Taking an Education Loan for Abroad Studies

Taking an education loan for studies abroad can be a complex process, but with proper planning and preparation, it can be made much easier. Here are some important things to remember while applying for an education loan:

- Eligibility Criteria: Before applying for an education loan, make sure you meet the eligibility criteria set by the lender. This includes your age, income, credit history, and other factors.

- Documentation: Keep all your important documents ready, such as your passport, admission letter, and financial statements. You may also need to provide a co-signer or collateral to secure the loan.

- Compare Interest Rates: Compare interest rates and repayment terms from different lenders to find the best deal. Don’t just go for the first loan offer you receive; shop around to find the best option for you.

- Loan Amount: Determine the exact amount you need for your education, including tuition fees, living expenses, and any other miscellaneous costs. Don’t borrow more than you need, as it will increase your repayments and interest charges.

- Repayment Options: Consider the repayment options available, such as deferred repayment or income-based repayment. Choose the option that works best for your financial situation and career goals.

- Loan Duration: The loan duration will affect the monthly repayment amount and the total interest paid. Choose a loan duration that fits your budget and career plans.

- Read the Fine Print: Read the loan agreement carefully before signing. Make sure you understand all the terms and conditions, including the interest rate, repayment options, and any penalties for default.

By following these tips, you can ensure that you get the education loan that’s right for you and your studies abroad.

Education Loan's Eligibility Criteria

Eligibility criteria for an education loan for abroad studies vary from lender to lender. However, there are some common eligibility requirements that you must meet to be considered for a loan.

Here are the most common eligibility criteria for an education loan:

- Citizenship: You must be an Indian citizen if you are applying for a loan from India.

- Age: Most banks/lenders require you to be at least 18 years old when you apply for a loan.

- Education: You must have completed your higher secondary education and be admitted to a recognized university abroad.

- Income: Lenders will also consider your family’s income when evaluating your loan application.

- Collateral: Some lenders may require you to provide collateral, such as property or fixed deposits, to secure the loan.

- Repayment history: Lenders might also check your credit score and repayment history to assess your loan application.

In addition to the above eligibility criteria, you will also need to provide the following documents:

- ID Proof: PAN card, Aadhaar card, Passport or Driver’s License.

- Admission letter: You must provide proof of admission to a recognized university abroad.

- Passport: You must provide a valid passport.

- Financial statements: You will also need to share your financial statements, such as bank statements. This is required to show that you have the funds to cover tuition and living expenses.

- Proof of income: Proof of your family’s income, such as salary slips or tax returns, will also be required.

- Collateral documents: If you’re required to provide collateral, you must provide proof of ownership.

- Guarantor form and documents: Most banks require a guarantor to co-sign the loan. You’ll need their ID and address proof.

- Passport-sized photos: 2-4 passport-sized photos for loan application and KYC (Know Your Customer) purposes.

By understanding the eligibility criteria and the documents required, you can ensure that your application is complete and accurate. With the right loan, you can finance your education abroad and achieve your dreams.

Factors That Impact Loan Amount an Applicant Is Eligible For

The amount of loan you’re eligible for is influenced by several factors. Here are some of the key ones:

- A course of Study: The course type you wish to pursue and the institution you want play a big role in determining the loan amount. Courses in popular fields such as medicine and engineering typically command higher loan amounts compared to others.

- Repayment Capacity: Your repayment capacity is evaluated based on your family’s income and assets. A higher income and more substantial assets increase your repayment capacity, which in turn increases the loan amount.

- Credit History: Your credit history is an essential factor that lenders consider when evaluating your loan application. A good credit score means you’re a low-risk borrower and you’re more likely to be eligible for a higher loan amount.

- Co-signer: Having a co-signer, such as a parent or a guardian, can also influence the loan amount. A cosigner’s income and assets are considered in the loan evaluation process, which can increase the loan amount.

- Loan Tenure: The loan tenure, or the length of time over which you plan to repay the loan, is another factor that influences the loan amount. Longer tenures typically result in lower EMIs, but the overall interest paid is higher.

By considering these factors, you can get a better idea of the loan amount you’re eligible for and plan your finances accordingly. You will also understand how to get an education loan for abroad studies and what is the best amount you can get. It’s essential to compare loan options from multiple lenders to ensure you get the best deal.

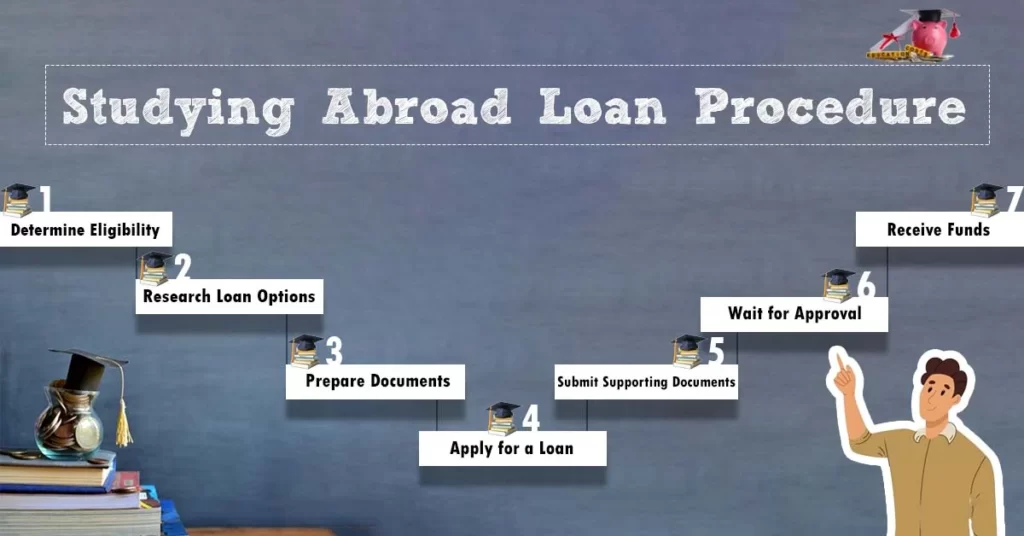

Studying Abroad Loan Procedure

Applying for a loan to study abroad can be a challenge, but not if you know the exact steps. While the procedure of applying for the loan might not be exactly the same, these are the basic steps you’ll need to follow:

- Determine Eligibility: The first step is to determine if you are eligible for an education loan for abroad studies. Most banks have specific eligibility criteria based on factors such as age, academic background, and financial status.

- Research Loan Options: Research various loan options available for students looking to study abroad. You can explore options from banks, financial institutions, and government-run education loan schemes.

- Prepare Documents: Prepare the necessary documents for the loan application. This typically includes identity proof, address proof, financial documents, admission letters, and educational qualifications.

- Apply for a Loan: Once you have all the required documents, you can apply for the loan. You can do this online or by visiting a bank branch. Some banks also offer loan pre-approval, which can make the process quicker.

- Submit Supporting Documents: After submitting your loan application, you will be required to submit supporting documents. This may include collateral or a co-signer if required by the bank.

- Wait for Approval: Once your loan application and supporting documents have been submitted, you will need to wait for the bank to process your loan application. The approval process can take several weeks.

- Receive Funds: If your loan application is approved, you will receive the loan funds. The funds can be disbursed directly to your education institution or to your account for you to use as required.

By following these steps, you can get an education loan for abroad studies with ease.

Collateral for Education Loan

Collateral is a valuable asset used as security for the loan. In case the borrower is unable to repay the loan, the lender can seize the collateral to recover the amount owed. Education loans for studies abroad often require collateral, which can be in the form of property, bonds, shares, or any other asset of significant value.

It’s important to understand that not all education loans require collateral. Unsecured education loans are available. But these loans generally have a higher interest rate and stricter eligibility criteria.

Here are some things to keep in mind when providing collateral for an education loan:

- Choose a suitable asset: The value of the collateral should be higher than the loan amount. Consider the current market value, ease of transfer, and risk of depreciation.

- Keep the collateral accessible: The lender should be able to access the collateral easily in case of default. Hence, the collateral should be located in the same country as the lender.

- Maintain the collateral’s value: It’s important to maintain the value of the collateral to ensure that it can be used to repay the loan if necessary. Regularly check the market value and take steps to protect it if necessary.

- Update the lender: If there are any changes to the collateral, such as a change in value or ownership, inform the lender as soon as possible.

Having a solid understanding of the collateral requirements for an education loan is key to securing the funding you need for your studies abroad. It’s always a good idea to consult with a financial advisor. They help you understand the requirements and also clear doubts about how to get a study loan for studies abroad.

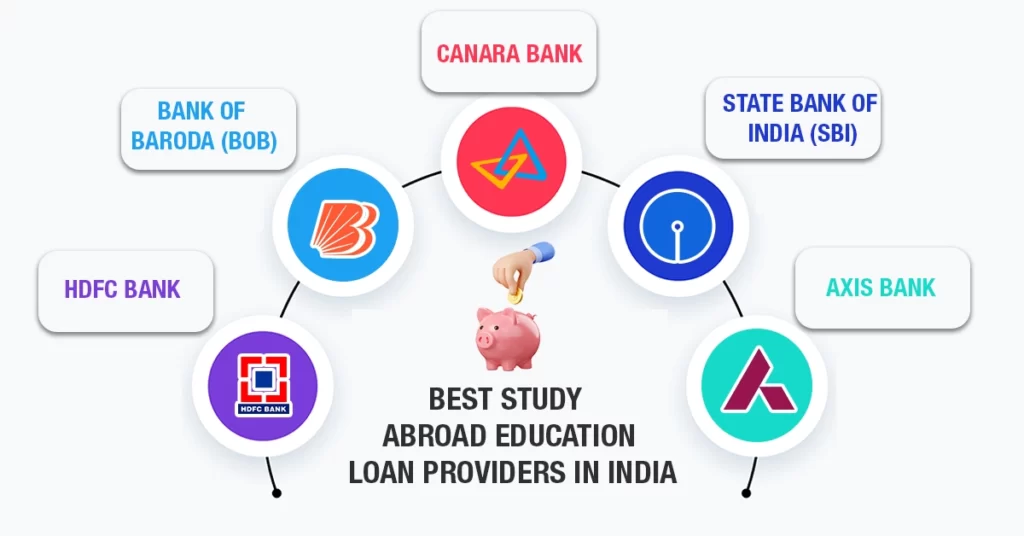

Best Study Abroad Education Loan Providers in India

If you’re planning to study abroad, it’s essential to research and compares education loan providers in India. Here are some of the best providers for your consideration:

State Bank of India (SBI)

- Offers education loans for full-time courses in recognized universities

- Provides coverage up to Rs. 20 lakhs

- Repayment period up to 15 years

- Minimal documentation required

Bank of Baroda (BOB)

- Offers loans for higher education in India and abroad

- Provides coverage up to Rs. 20 lakhs

- Repayment period up to 15 years

- Attractive interest rates

Axis Bank

- Provides education loans for full-time courses in recognized universities abroad

- Offers coverage up to Rs. 50 lakhs

- Repayment period up to 15 years

- Simple and fast loan disbursal process

HDFC Bank

- Offers education loans for full-time courses in recognized universities abroad

- Provides coverage up to Rs. 20 lakhs

- Repayment period up to 15 years

- Attractive interest rates and flexible repayment options

Canara Bank

- Offers education loans for full-time courses in recognized universities abroad

- Provides coverage up to Rs. 20 lakhs

- Repayment period up to 15 years

- Minimal documentation required

When choosing an education loan provider, it’s important to consider factors such as interest rates, repayment options, and loan coverage. Do your research and compare multiple providers to find the best option for your needs.

How to Choose Bank for Study Abroad's Education Loan?

Choosing the right bank for your education loan to study abroad is crucial for your financial success. Here are some key factors to consider:

- Interest Rates: Compare interest rates offered by different banks and choose the one that offers the lowest rate. This will reduce the total cost of your loan and help you save money in the long run.

- Repayment Options: Look for banks that offer flexible repayment options. This will help you manage your loan payments after graduation without putting too much strain on your finances.

- Eligibility Criteria: Each bank has its own eligibility criteria for education loans. Make sure you meet the requirements before applying.

- Processing Time: Consider the processing time of the loan. Some banks can take several months to process your loan, while others can do it much faster. Choose a bank that can provide you with the funds in a timely manner.

- Customer Service: Choose a bank with a good reputation for customer service. This will ensure that you have access to support when you need it.

- Co-Signer Requirements: If you are an international student, you may need a co-signer to apply for an education loan. Make sure you understand the co-signer requirements before choosing a bank.

- Prepayment Penalties: Check if the bank charges any prepayment penalties. This will allow you to pay off your loan early without incurring any additional costs.

These factors will help you choose the best bank for your education loan to study abroad. If you are still confused about the best bank or how to get an education loan for abroad studies, take professional help!

Education Loan from NBFCs for Study Abroad

Studying abroad can be a life-changing experience for students, but the cost of education can be a significant hurdle for many. In such cases, an education loan from a non-banking financial company (NBFC) can be an option to fund your overseas education.

First, it’s essential to understand what an NBFC is. Unlike banks, NBFCs are financial institutions that provide various financial services, including loans, without having a banking license. They are regulated by the Reserve Bank of India (RBI) and offer customized loan products to cater to individual needs.

When it comes to studying abroad loans, NBFCs offer loan amounts ranging from Rs.1 lakh to Rs.1.5 crore, depending on the course, country, and financial standing of the borrower. The repayment period can range from 5 to 15 years, depending on the loan amount and the interest rate.

To apply for an education loan from an NBFC, you need to meet the eligibility criteria, which may vary from one NBFC to another. Generally, you must be an Indian citizen and have secured admission to a recognized university or college overseas. You must also have a co-applicant who is an Indian citizen and has a stable income source.

Moreover, you need to provide some essential documents while applying for an education loan. Also, you may need to submit collateral or security, such as property, fixed deposit, or any other asset, depending on the loan amount.

The interest rate on education loans from NBFCs may vary between 10% to 14%. Some NBFCs also offer a concession on the interest rate for female students and for students with a good academic record.

Conclusion: How to Get an Education Loan for Abroad Studies?

Getting an education loan for studying abroad can be a lengthy process, but here are some general steps to help you get started:

- Determine the estimated cost of studying abroad.

- Look for banks or financial institutions that offer education loans for studying abroad.

- Check the eligibility criteria of chosen bank or financial institution.

- Gather the required documents.

- Apply for an education loan.

- The bank will review your application and conduct a credit check.

- Review the loan offer carefully and make sure you understand all the terms and conditions.

- The bank will disburse the loan amount to your university or directly to you, depending on the terms of the loan.

- It’s also a good idea to plan ahead and start the process early to allow enough time for any potential delays or complications.

FAQs:

Which bank gives the highest education loan without collateral for abroad?

Many banks offer education loans without collateral for abroad studies. The loan amount and interest rates may vary depending on the bank and the student’s profile. However, some banks that offer high loans without collateral are SBI, Axis Bank, HDFC Bank, Bank of Baroda, ICICI, etc.

How much education loan can I get to study abroad?

The maximum education loan amount that you can get for studying abroad depends on various factors, such as the country, the course, and the financial standing of the borrower and the co-applicant. Generally, most banks and financial institutions in India offer education loans of up to INR 20-30 lakhs (approximately $27,000-$40,000) for studying abroad.

Which bank provides education loans easily?

Some banks provide education loans easily, but it depends on the borrower’s eligibility criteria and the documents submitted. Many public sectors banks like SBI, Punjab National Bank, and Canara Bank are known to offer education loans at competitive interest rates.

What is the fastest way to get a student loan?

The fastest way to get a student loan is to apply for a loan through a lender or NBFC that offers an online application process and quick approval times. It’s important to note that fast approval times may come with higher interest rates or stricter repayment terms. So, make sure you understand the terms and conditions of the loan before accepting it.

What is the max student loan amount?

The maximum student loan amount varies depending on the bank or NBFC and the borrower’s profile. In India, the maximum education loan amount that can be borrowed is generally up to INR 20-30 lakhs (approximately $27,000-$40,000) for studying abroad. However, some banks and financial institutions may offer higher loan amounts depending on the course, university, and financial need.

How can I increase my chances of getting a student loan?

To increase your chances of getting a student loan, maintain a good academic record, secure admission to a recognized university or college, have a co-applicant with a stable income source, and submit all necessary documents along with the loan application.

Can I get an education loan without income proof?

Many banks and NBFCs require income proof of the co-applicant to sanction education loans. However, some banks offer loans without income proof, provided the co-applicant has a good credit score, and the student has secured admission to a reputed institution.

Can I get a 100% loan to study abroad?

No bank or NBFC provides a 100% education loan to study abroad. However, many banks offer education loans for up to 90% of the total expenses, and the remaining amount needs to be paid by the student or their family.